In 2023, Washington State authorized a landmark study into its role in housing discrimination and the racial gap in homeownership that persists today. Released in March 2024, Washington’s historic Covenant Homeownership Study laid the groundwork for a new program that specifically targets the victims of its actions to foster homeownership.

It’s time Oregon took a similar look in the mirror, say a coalition of housing advocates, who want the state to conduct its own study, modeled on Washington’s, into its history of discriminatory housing policies and create a program to bridge the homeownership gap for communities of color that persists in their wake.

“There was real harm in restricting access and forcibly taking generational wealth on the basis of race and ethnicity,” said Shannon Vilhauer, executive director with Habitat for Humanity Oregon.

Habitat for Humanity Oregon is a leading voice in the Unlocking Homeownership Coalition, a statewide alliance of housing, real estate, financial and advocacy organizations. The covenant study is just one of several initiatives the coalition is proposing in Oregon’s current legislative session to move the needle on the state’s housing crisis.

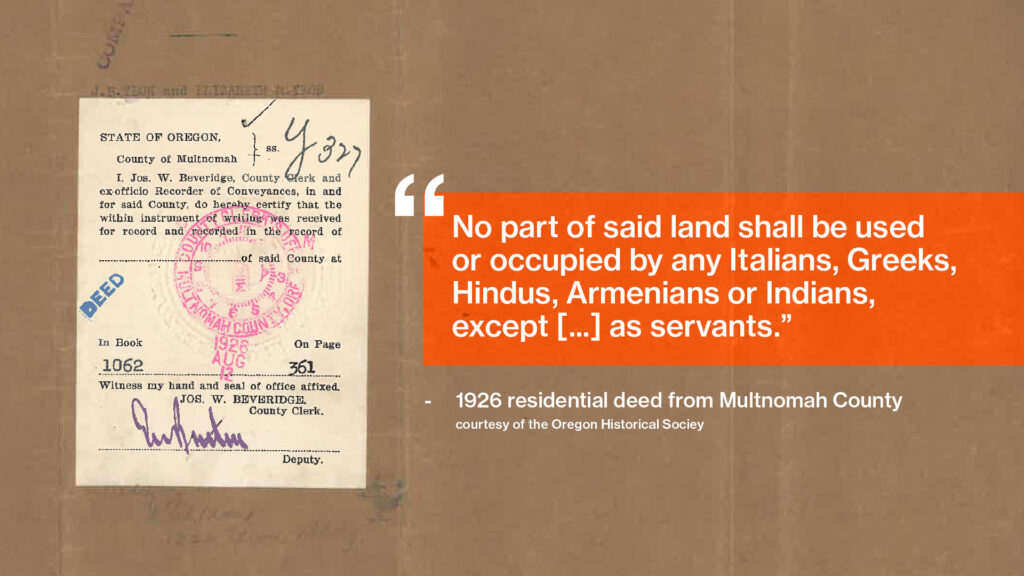

The Covenant Homeownership Study draws its name from the restrictive clauses, or covenants, inserted into property deeds that expressly denied ownership or occupation to people based on their race, ethnicity, or religion, other than as servants. Those covenants still exist on property deeds in Oregon and elsewhere today.

Washington’s study was the basis for that state’s groundbreaking Covenant Homeownership Program, launched in July 2024, which provides substantial down payment and closing cost assistance in ways previous programs have not. First, it provides for large enough loans to make a home attainable for qualifying homebuyers in the county where they live. Second, it makes those loans exclusively available to groups of people who both suffered housing discrimination by state institutions in the past and continue to show the effects of disparities today.

Like Washington, Oregon’s Black homeownership rate is 30% below that of White Oregonians, according to Oregon’s recent State of the State of Housing report. That 30% gap for is the same as it was more than 50 years ago, despite passage of the Fair Housing Act. Taken as a whole, Oregonians of color own homes at a rate 15% below their White counterparts.

The history of exclusionary policies, along with the wealth gap, and institutional barriers continue to prevent people of color from buying a home in an already challenging housing market. Overall, Oregon ranks 43 in the nation for homeownership, with home prices having nearly doubled in the past decade, far outpacing incomes. The report calls for investments in a spectrum of housing services to correct the persistent challenges to housing across the state.

Racially restrictive covenants, along with land seizures, redlining, and other discriminatory lending practices, were banned in 1968 by the Federal Fair Housing Act. But that did not erase the ongoing harm they cause, Vilhauer said. “One generation ago, was not long ago.”

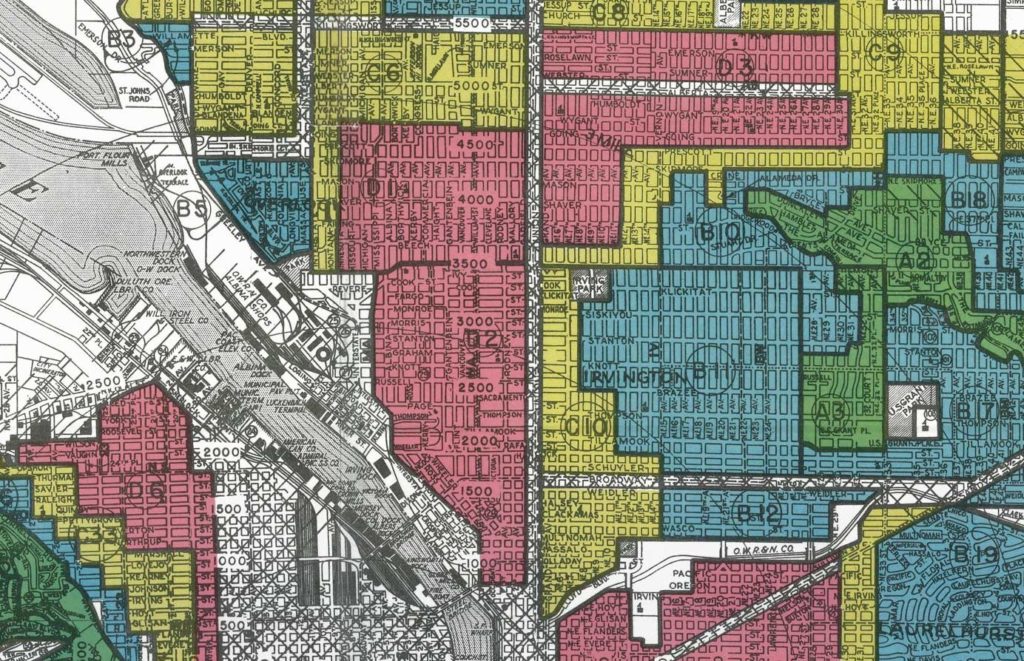

Washington’s study chronicled a host of discriminatory actions abetted by the state, including land seizures, forced removal of residents, exclusionary zoning practices, racist practices in the state-licensed real estate industry. It also documented over 50,000 racially restrictive covenants barring people of color and other marginalized groups from purchasing homes and living in specific neighborhoods, leading to widespread segregation and confinement.

Other laws further displaced Native Americans from non-reservation land and excluded Black people and other people of color from wealth-building opportunities offered Whites, while Native Americans, Black Washingtonians, and other people of color lost access to resources and opportunity, the report states.

State courts in Washington and across the country reinforced these and similar practices. Decades after these policies were banned, those actions continue to have a detrimental impact on wealth, housing cost burdens, homelessness, access to mortgage lending, and appraisal disparities.

Some people may know of the history of these practices in general, but not always the direct impact they had on their own community, said Vilhauer, or the larger consequences that continue today.

Oregon joined the United States in 1859 with a constitutional prohibition against Black settlers in its boundaries, even as it offered White people land incentives to move here. The city of Portland has a history of allowing redlining and other discriminatory policies that stifled homeownership and segregated people of color to underdeveloped neighborhoods, such as the Albina District, in residential patterns that exist today.

(Read Habitat’s series on the region’s history of housing discrimination here.)

Eugene was considered a “sundown town” that prohibited Black people from living in its boundaries. In 1949, the only predominately Black community then existing in Lane County was razed at the county’s order to build a bridge, according to Eugene city records.

Many Oregon cities had sundown laws, Vilhauer said, and knowing that history, specific to communities and the state, is important.

“When specific harm is surfaced and talked about, it helps to generate more appropriate solutions to address that harm,” Vilhauer said.

A covenant homeownership study is only the starting point in correcting the ongoing housing and wealth disparities, and one of several recommendations from the Unlocking Homeownership Coalition. Others include funding for building new homes across Oregon, down payment assistance for first-time homebuyers, and individual development accounts that help individuals save for big goals, including homeownership, education and starting a business.

Learn more about the coalition’s work at homesfororegon.org.