Starter homes – modest in size and price – used to be a gateway for first-time homebuyers to begin building equity and a lifetime of stable homeownership.

That gateway, however, has significantly narrowed, as the housing shortage has placed a premium on smaller homes that used to fit the budget of a first-time, entry-level buyer. And as far as new construction is concerned, they sure aren’t building ‘em like they used to.

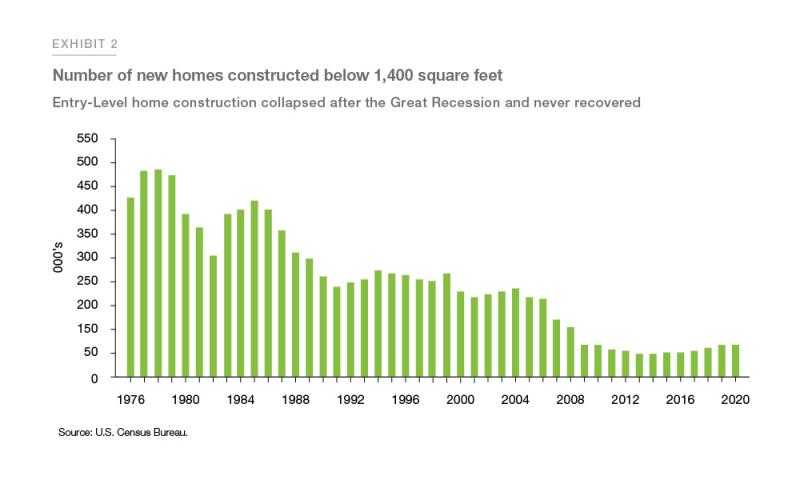

A 2021 report from Freddie Mac states that almost every state in the nation is building fewer of these starter homes. In 1980, 40% of homes constructed were considered entry-level homes. In 2019, that number was down to 7%. The Freddie Mac report specifically calls out the decline in the construction of entry-level single-family homes, or starter homes, as exacerbating the overall housing shortfall the market is experiencing today.

“The main driver of the housing shortfall has been the long-term decline in the construction of single-family homes and that decline has been exacerbated by an even larger decrease in the supply of entry-level single-family homes, or starter homes,” researchers wrote in the Freddie Mac report.

“The combination of low supply (especially entry-level) and high demand (especially entry-level)” the Freddie Mac report states, “is causing entry-level prices to rapidly escalate well above overall prices, triggering affordability issues for buyers to come up with even larger down payments.”

Locally, the inventory for both new and existing homes for sale is at a historic low: Analysis by both the state of Oregon and the city of Portland show the region is short tens of thousands of housing units to meet the current need, much less the demand ahead.

Statewide, over the next 20 years, Oregon’s communities will need to add more than 550,000 units, more than 30 percent of which will house Oregon’s lowest-income residents and will most likely require public funding or subsidy, according to the state’s 2022 housing needs assessment. The city of Portland alone is expected to grow by more than 100,000 households in the next decade, according to city analysis.

So why not build more starter homes? Today’s higher costs of land and material, coupled by the demand-driven higher prices, make smaller, starter homes less profitable for developers. Part of the affordability of starter homes is their size. Freddie Mac defines a starter home at 1,400 square feet or smaller. But new homes nationally have increased significantly in size over the years, with the average hovering around 2,300 square feet today.

Labor costs, government fees, and various building regulations are also blamed for driving up the incentive to build larger, more expensive homes to cover costs.

Since 2015, the year the city of Portland declared a housing emergency, home prices across the region have risen by double digits, and the median home price in the area now exceeds half a million dollars. In Portland, less than one-third of for-sale home listings in 2022 were considered affordable to households earning the area median income, or $114,000 for a family of four.

Today, the median rent for a 2-bedroom apartment in the Portland metro area is nearly $1,900, and balloons to over $2,600 for a family-sized, 3-bedroom rental. In 2021, more than half of the region’s renter households were considered cost-burdened by federal housing standards, with 1 in 4 paying more than half their income in rent.

The housing affordability gap expands for Black, Indigenous, and Latine households, who, based on average incomes and home sales prices, cannot afford to buy a home in all but a few neighborhoods in Portland. Nationally, at 30 percent, the gap between Black and White homeownership is as bad as it was in 1900, more than 100 years ago. More recently, high interest rates pushed homeownership for many even further beyond reach.

In 2019, Oregon became the first state to put an end to single-family zoning. The goal was to increase housing equity by allowing denser housing units – such as duplexes, triplexes, etc. – to be built in most city neighborhoods that previously only allowed single-family houses. They’re often called the “missing middle,” and the hope is it will spur the creation of more homes for new homebuyers starting out.

Habitat for Humanity Portland Region is currently one of the few builders of entry-level homes for first-time homebuyers. In 2023, Habitat Portland constructed 34 homes, and currently have more than 100 homes under construction.

Habitat homes are built for lasting affordability. This allows homeowners to continue building equity in their homes, while ensuring that the homes are affordable to the next buyers.

Habitat is dedicated to building affordable, entry-level homes for first-time homebuyers, and helping renters achieve the stability and economic potential inherent in homeownership.

Correcting our housing crisis also means preserving the existing homes for people facing financially challenging repairs. Habitat’s Home Repair program fixes acute housing problems for qualified homeowners and improves the safety of their homes. This is especially important for older homeowners and people with disabilities — the majority of those served by Habitat’s repair program — who can then age in place, in their neighborhood, and continue to access their local community and support networks.

Selected sources:

Oregon 2022 Housing Needs Analysis

Additional information: https://www.corelogic.com/intelligence/achieving-affordability-comparing-the-housing-market-during-the-boomer-era-to-the-present/